Top 5 Mistakes Teams Make With Token Unlocks (And How to Avoid Them)

Avoid price crashes, reputational damage, and operational headaches by fixing these common token unlock mistakes.

Token unlocks can define the success of a project. A badly managed token unlock process can lead to detrimental price performance, hurt your credibility, and alienate your community.

Tokenomics are a key part of a project’s lifecycle and should definitely not be neglected. Here are the top mistakes we have seen projects make across the years, as well as how they can be prevented.

1. Using a Custom Vesting Contract

Token distribution is a whole industry in and of itself. It’s a complex subject, with hundreds of different ways of approaching the problem, dozens of different solutions, etc.

In that context, it makes no sense to build your own vesting contracts. Unless you pay for audits, making it even more expensive, there are major security risks in doing so. Recipients will also face a subpar claiming experience, unless you build an interface on top of the vesting contracts, adding even more engineering work to the table.

And what about support requests? Recipients will inevitably have issues claiming, questions, etc. are you willing to handle this too?

You can read more about the downsides of custom vesting contracts here, and how Sablier is a much better fit.

2. Manually Distributing Tokens

Instead of building custom vesting contracts, some projects opt for manual token distributions, where they will either distribute tokens via ERC-20 transactions every month, quarter or year, or alternatively do so when requested by an eligible recipient to avoid triggering a periodic tax event.

This is a subpar solution, as it takes up a lot of your time, and recipients have to trust they will indeed receive the tokens. Distributing tokens in this fashion on a regular basis is also error-prone. Mistakes happen, what if you send tokens to the wrong address?

With a token vesting solution like Sablier, vesting streams can be created in a “set-and-forget” approach. Treasury managers love Sablier for that reason. Made a mistake? Simply cancel the stream and get the unpaid funds back.

The core Sablier protocol is fully immutable, meaning no trust is required in Sablier, and recipients can rest assured knowing that their tokens are being vested through extensively audited and battle-tested onchain infrastructure.

3. Not Vesting Tokens to KOLs

It’s customary to give Key Opinion Leaders (KOLs) a token allocation for marketing purposes. However, many projects make the mistake of not vesting those tokens, resulting in immediate token dumping, which in turn results in reputational damage for the project.

It’s bad optics, it’s an erosion of trust, it’s retail getting REKT. It’s just not worth it.

Token vesting solves this problem by spreading out token unlocks over time, up to the second if you want to, making the price action of your token smoother, and leading to stronger investor confidence as well as better incentives for KOLs.

Instead, vest these tokens over time. Here is a blog post explaining why and how to do so.

4. Lacking transparency

This happens often with manual vesting, where projects won’t publicly communicate vesting schedules and projected token supply growth. For many this is an instant turn-off, as it makes it impossible to know whether an insider has the capability to dump a large allocation of tokens at any given time, leading to uncertainty. And markets hate uncertainty.

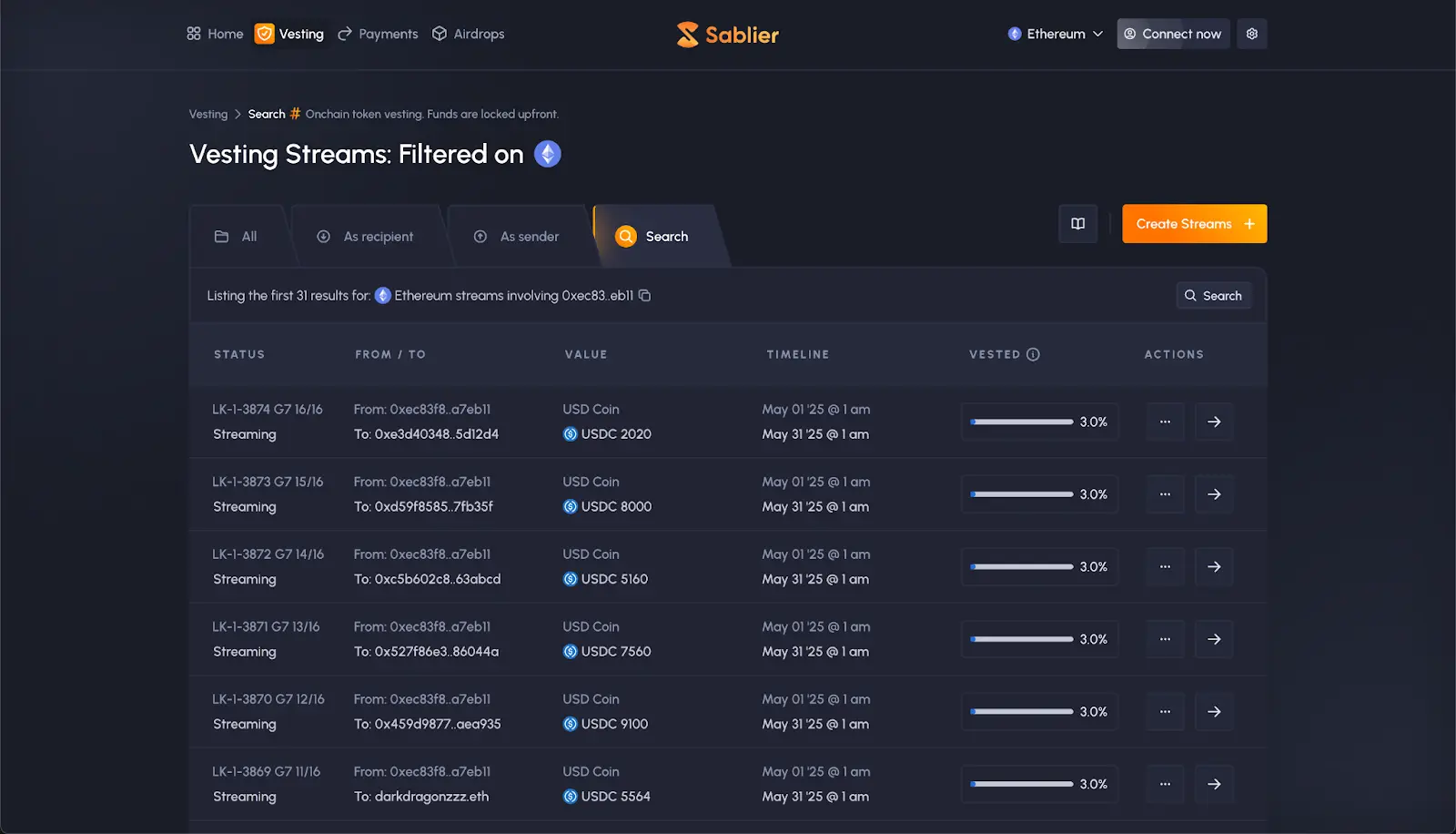

Sablier makes transparency very easy. You can share with CoinMarketCap, CoinGecko, and other price trackers the Sablier vesting contract address on the chain you are vesting on, allowing them to automatically filter out tokens locked up in Sablier from the circulating supply.

You can alternatively also simply share the links to the vesting streams to your community. Sablier makes this incredibly easy, by allowing you to share a page with all the streams created by your address. Here is an example.

5. Not following the standard 1-year cliff + 4-year vesting model

There is a reason why a 1-year cliff and four-year subsequent linear vesting is customary in Silicon Valley. It’s because it works. It’s because it creates the right incentives. It’s because it’s been proven to lead to the right outcomes in countless cases.

If one of your employees, for example, walks away within the first year of launching the token, they receive no tokens under this model. This forces long-term alignment and commitment from key stakeholders, as they only start receiving tokens a year after the token is launched, and only linearly from that point on, taking another four years to get to the full allocation.

Avoiding a cliff leads to short-term incentives, and the case is similar when shortening the vesting period. On the other hand, making the cliff or vesting period longer may lead to disappointments inside of your team or among key stakeholders.

The reality is simple. You should use a 1-year cliff and a four-year vesting plan. There is a reason why it’s the standard. The good news is you can do so using Sablier.