Best Crypto Custody Solutions for DAOs and Companies (2025)

The choice of a custodian is a critical decision for a DAO or company in the crypto industry.

There are both centralized and decentralized custodians. Some rely on a multisignature (multisig) setup, some rely on multi-party computation (MPC), and some rely on cold storage. Some custodians exclusively work on EVM blockchains, others work across smart-contract and non-smart-contract blockchains.

Each solution has its strengths and weaknesses. This guide compares the top custody solutions—including Safe (formerly known as “Gnosis Safe”), Fire Blocks, Copper, Anchorage, BitGo, and Coinbase Custody—analyzing their security models (multisig, MPC, cold storage), user experience, pricing, regulatory compliance, and suitability for different organizational needs.

Solutions

Safe

Safe is the only decentralized custody solution on the list. It’s fully onchain and relies on a multisig model. This means one or more signatures by the wallets in control of the multisig are required for a transaction to be approved. A 2 out of 5 Safe multisig, for example, requires 2 signatures out of five eligible signers, for a transaction to be approved.

Safe is the ideal solution for DAOs as it’s fully onchain, making it publicly auditable, and it doesn’t require sign ups. Just connect your wallet, and you’re good to go.

One possible downside for Safe is it does require gas fees as it’s fully onchain, and it’s only available across EVM networks, like Ethereum, Arbitrum, etc. Blockchains like Bitcoin, or Solana, are not supported. There is also a smart contract risk if Safe’s contracts were hacked, though Safe has been around for over seven years now, and the contracts have never suffered a breach.

Given Safe is open-source, modular and publicly auditable, it’s an ideal solution for developers.

Safe is not a licensed custodian (it can’t be given it’s decentralized), and does not offer built-in compliance tools.

Safe is entirely free to use, aside from the blockchain gas fees, of course.

Fireblocks

Fireblocks is a centralized custodian relying on MPC to secure its custody solution. The private keys of Fireblocks wallet are split into shares, following the MPC process. Fireblocks is ideal for institutions as it’s less difficult to use than Safe and the transaction approval process if offchain.

In contrast with Safe, Fireblocks has the advantage of being available on practically every major blockchain out there, including Bitcoin, Ethereum, Solana, etc. as it relies on MPC technology, as opposed to onchain signatures through a multisig model like Safe.

One of the downsides of Fireblocks is trust is required in Fireblocks given it’s a centralized, proprietary and closed-source solution.

Fireblocks is not a licensed custodian, but does offer certain compliance features.

Plans start at $2,400/year with an added 0.23% transaction fee, and go up to $25,000/year depending on how many assets you have under custody.

Copper

Copper is a centralized custodian, which like Fireblocks, relies on MPC for transaction approvals.

Copper is ideal for hedge funds and traders, as its ClearLoop solution allows users to trade assets on centralized exchanges while not leaving Copper’s MPC custody. This ensures that if a centralized exchange on which a Copper user trades is hacked, the user’s funds will remain safe.

Like Fireblocks, Copper has the advantage of being available on practically every major blockchain out there, and the downside of having to trust Copper as it’s a centralized, proprietary and closed-source solution.

Copper is not a licensed custodian, but does offer certain compliance features.

Copper’s pricing isn’t public.

Anchorage

Anchorage is a leading custodian when it comes to compliance, being legally structured as a US-based bank, and being used by the US Department of Justice to be the custodian for all digital assets seized or forfeited in criminal cases. Anchorage relies on cold storage to secure its user funds.

Importantly, Anchorage also supports fiat custody, allowing users to store both fiat and crypto in their account.

Like Fireblocks and Copper, Anchorage has the advantage of being available on practically every major blockchain out there, and the downside of having to trust Anchorage as it’s a centralized, proprietary and closed-source solution.

Transactions can also take longer to process than other custody solutions, as biometric voice and video approval are used to validate transactions, and Anchorage reviews transactions before submitting them to the blockchain to authenticate each approval based on detailed behavioral analytics.

Anchorage is ideal for funds and organizations needing regulated custody.

Anchorage’s pricing isn’t public.

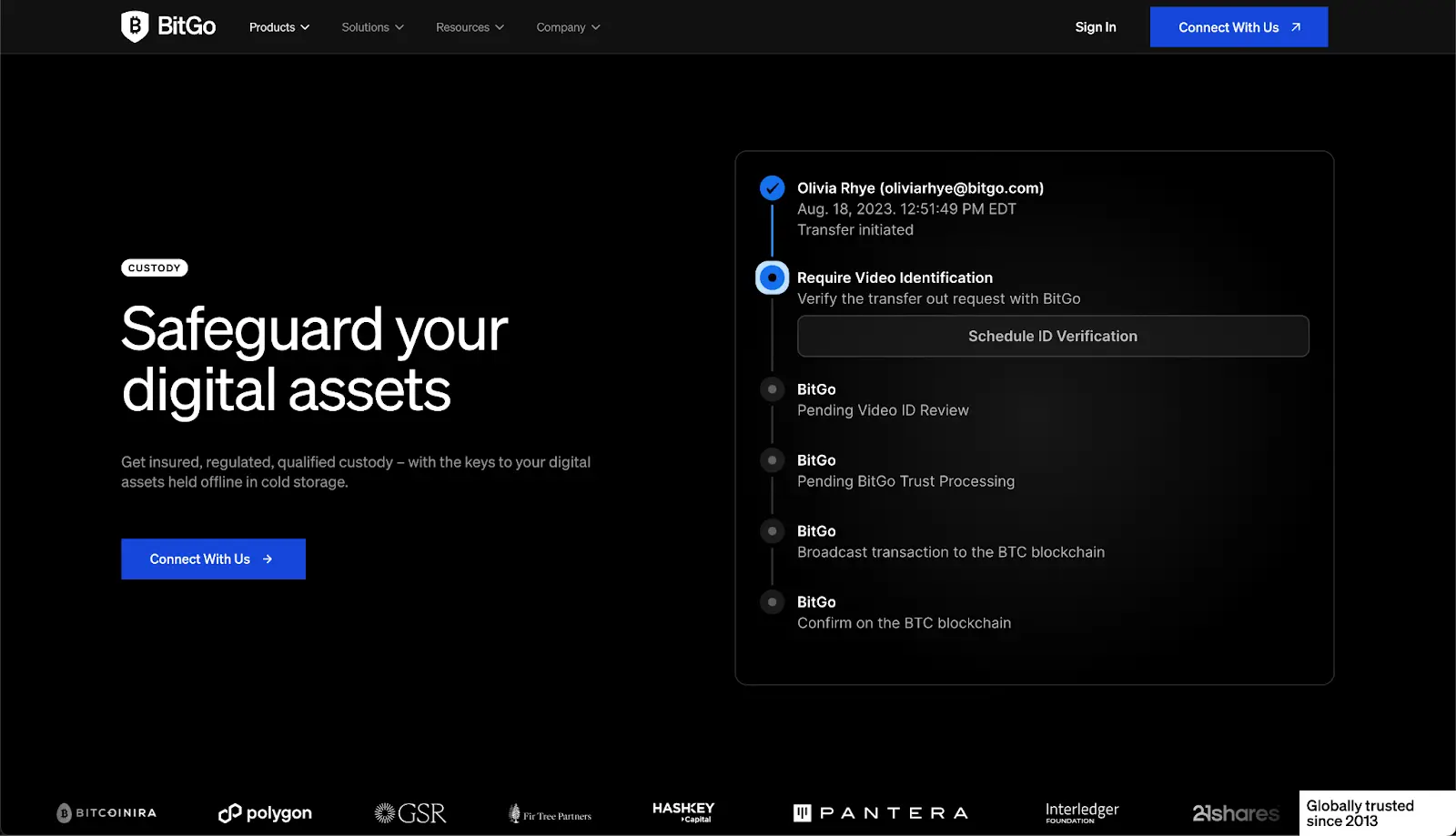

BitGo

BitGo is another compliance-focused custodian. Like Anchorage, BitGo relies on cold storage, with users needing to pass a series of security checks, like video identification, to perform a transaction.

Notably, BitGo has a $250M insurance policy and a bankruptcy-remote structure, to offer peace of mind to its users. BitGo is used by several crypto ETF providers for custody.

Like Fireblocks, Copper and Anchorage, BitGo has the advantage of being available on practically every major blockchain out there, and the downside of having to trust Anchorage as it’s a centralized, proprietary and closed-source solution.

Like Anchorage, transactions can also take longer to process than other custody solutions, as several checks are performed when submitting a transaction.

BitGo is ideal for large institutions where compliance is a strong need.

Bitgo’s pricing isn’t publicly available.

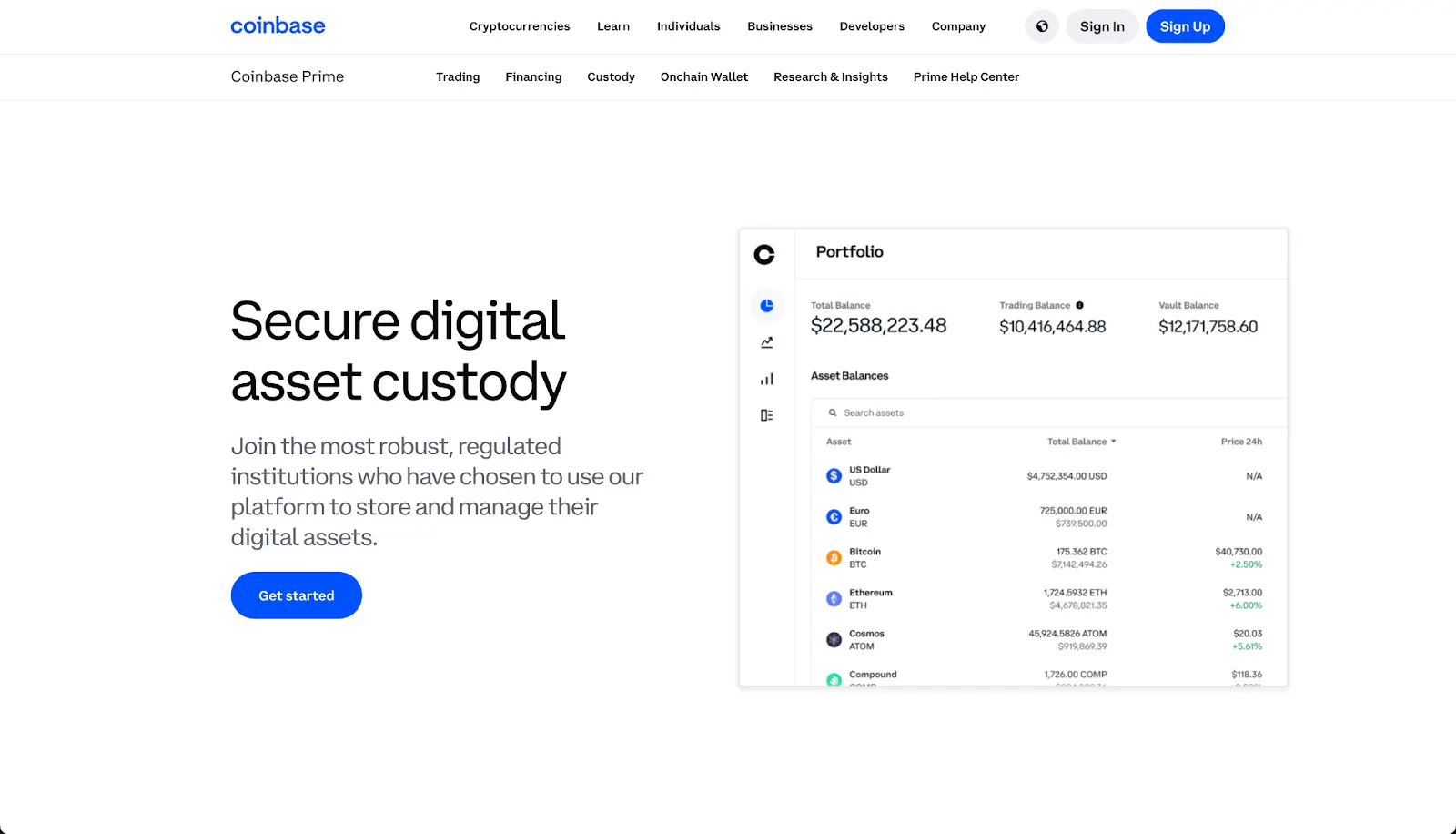

Coinbase Custody

Coinbase Custody is custodian regulated as a New York trust, offering insured cold storage for organizations and institutions.

Like Fireblocks, Copper, Anchorage and BitGo, Coinbase Custody has the advantage of being available on practically every major blockchain out there, and the downside of having to trust Coinbase as it’s a centralized, proprietary and closed-source solution.

Like Anchorage and BitGo, transactions can also take longer to process than other custody solutions, as several checks are performed when submitting a transaction.

Coinbase custody is ideal for companies and institutions looking to interact with the wider crypto ecosystem while being compliant.

Coinbase Custody’s pricing isn’t public.

Conclusion

For DAOs, Safe is really the ideal solution. It’s both decentralized and open-source, while being completely onchain and fully compatible with DeFi and onchain governance participation.

For companies in need of regulatory compliance, Anchorage, BitGo and Coinbase Custody are the options to look into.

For large institutions that trade assets and need scalable custody, Fireblocks and Copper are optimal.

Many organizations will combine two or more custodians, using Safe for onchain activities, for example, while storing strategic holdings in an insured custodian like Anchorage or BitGo.