Using Sablier For Token Vesting

Streamline your vesting process in seconds using the leading token streaming protocol.

What Token Vesting Is

Let's start by introducing the basic concepts.

Vesting is the act of restricting the ownership of a financial asset for a predefined period of time. Put simply, it's the duration a founder, employee, or investor has to wait to obtain complete control over their assets.

Like regular stock option programs in traditional finance, crypto has token vesting programs. These usually come under the umbrella of the token economics of the project. And just like in the traditional world, this is usually done via monthly or quarterly unlocks, when vesting recipients receive a share of their allocation.

There is also a cliff period. This is an initial duration during which recipients are not entitled to any tokens. At the end of this cliff, a predetermined quantity of tokens becomes instantly accessible. For instance, a vesting scheme could incorporate a one-year cliff, followed by a three-year program where tokens are unlocked on a monthly basis.

Additionally, it's not uncommon for tokens to be released when certain predefined objectives or milestones are achieved.

Benefits of Vesting in General

There are several benefits to vesting. Incentive alignment is one of the major ones. A vesting program ensures stakeholders remain committed to the project by creating a significant long-term financial incentive. This increases employee retention and ensures they remain engaged with the project.

Additionally, having a vesting program reduces the risk of dumping, as stakeholders receive their tokens over time instead of all at once and are aware that they will still be receiving some in the future, too. Thus, stakeholders are tied to the project's long-term future. It is in their best interest for the project to do well. By extension, the ability of an investor to pump and dump the token is severely limited.

Yet another benefit is that the team behind the token has sufficient time to deliver the product/ service they are working on. Quite often, an organization will launch a token and release their product/service only later. This is usually done via an airdrop, an ICO, IEO, or other mechanism.

Without vesting, stakeholders could sell their whole token allocation before launch, meaning the team wouldn't have time to demonstrate the quality of their product/service and, by extension, the utility of their token. A vesting schedule ensures the team has sufficient time to deliver on their promises.

However, we've only talked about the benefits of vesting in the general case. When it comes to implementing a token vesting program, traditional approaches present several problems.

The Problems with Traditional Token Vesting

- Custom development: the standard approach is to write and deploy a custom smart contract for vesting. This demands additional development efforts, security considerations, and a dedicated claiming interface for recipients, which leads to a clunky user experience.

- Manual payments: the vesting contract is often accompanied by a labor-intensive process once every X months, requiring signers to coordinate and manually sign the unlocks. This process is not only cumbersome but also places trust in the company to follow through.

- Expensive fees: deploying custom vesting contracts costs a significant amount of gas.

No one wants to spend hours, or even days, setting up a complex vesting program for their new token. And no one wants to manually claim their vesting allocation from a custom vesting contract on Etherscan.

Additionally, the predictable release of traditional vesting schedules presents risks such as the potential for speculation and rapid selling of tokens by recipients.

So how do we solve all this? With Sablier!

Introducing Sablier

Let's first talk about what Sablier is.

Sablier is a fully decentralized token streaming protocol available on multiple EVM chains, including Ethereum, Optimism, Arbitrum, and Polygon. It is the first of its kind ever built in web3, tracing its origins back to 2019. Today, hundreds of organizations like Shapeshift, Nouns DAO, Aragon, and Reflexer use Sablier for vesting, payroll, airdrops, and more.

We use "streaming" to refer to the continuous allocation of on-chain assets.

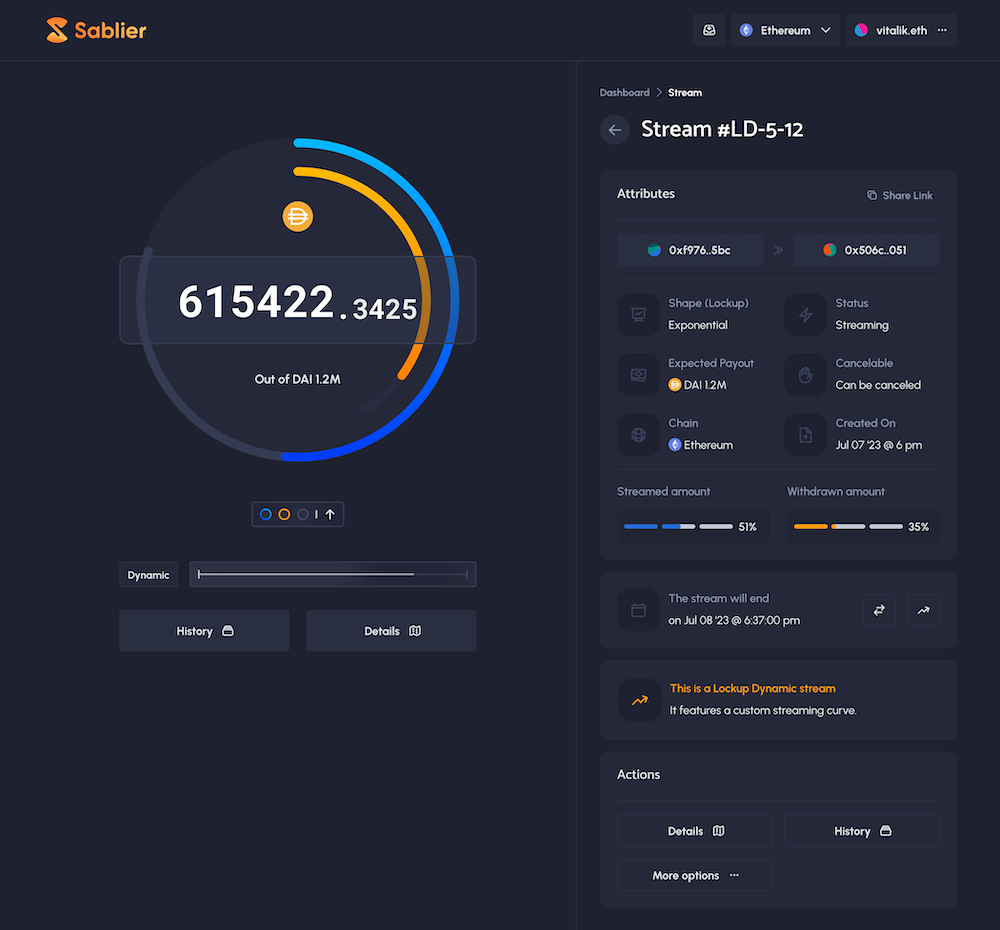

The way it works is that the creator of the vesting plan deposits a specific amount of ERC-20 tokens in a contract. Then, the contract progressively allocates the funds to the recipient, who can access them as they become available over time. The payment rate is influenced by various factors, including the start and end times, as well as the total amount of tokens deposited.

For more details, please visit our website and our documentation.

Why You Should Use Sablier for Vesting

Sablier is entirely free to use and is a proven solution with a median monthly TVL of $174M between 2021 and 2023 (see our listing on DefiLlama).

Sablier solves all of the problems of traditional vesting:

- End-to-end user experience: we offer a platform for both senders and recipients to monitor and manage their outgoing and incoming vesting plans (referred to as "streams").

- Full Automation: setting up the vesting plans only has to be done once. Treasury admins do not have to initiate monthly transactions anymore.

- Cost-effective: creating Sablier streams is up to 90% cheaper than deploying traditional vesting contracts. The Sablier contracts are already deployed and ready to use.

Features

What other features are supported by Sablier?

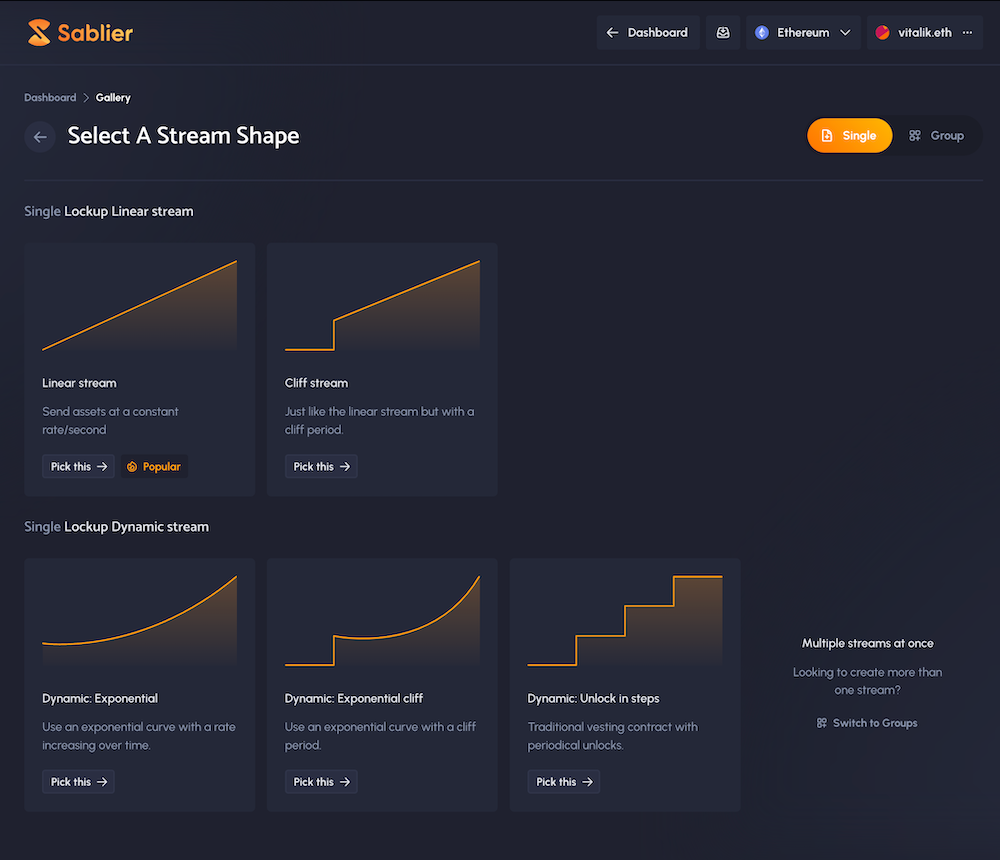

- Cliffs: cliff periods are supported.

- Flexibility: the payment granularity can be continuous (every second), discrete (every day, every week, etc.), or even non-linear (exponential, logarithmic, etc.). Advanced payment schemes, such as back-loaded vesting, are also supported.

- Batch: it is possible to create up to ~100 streams with one transaction.

- Cancelability: streams can be either cancelable or non-cancelable. If cancelable, the sender can recover the unstreamed funds if an employee/contributor leaves or certain KPIs aren’t met while the stream is still running.

- NFT Representation: every stream is wrapped in an NFT owned by the recipient. The NFTs are visually represented as on-chain generated hourglass SVGs, and they can be deposited in third-party protocols and transferred to other wallets.

- Flexibility: streams can be created via our interface, by manually calling our contracts, or via our Safe multisig app, making Sablier an excellent fit for any setup.

Conclusion

Sablier provides an incredible user experience for token vesting, solving all problems associated with traditional vesting. Our protocol has been a game changer for hundreds of web3 organizations, helping them with their token vesting programs and racking up transaction volumes in the hundreds of millions.

You can get started by using our app here:

app.sablier.com

For more information about how Sablier can help you set up the perfect vesting program, check out our website here.

Oh, and did we mention that Sablier is completely free to use?