Total Obtainable Value: A New Methodology for Evaluating Vesting Tokens

Introducing Total Obtainable Value (TOV): A New Methodology for Evaluating Vesting Tokens

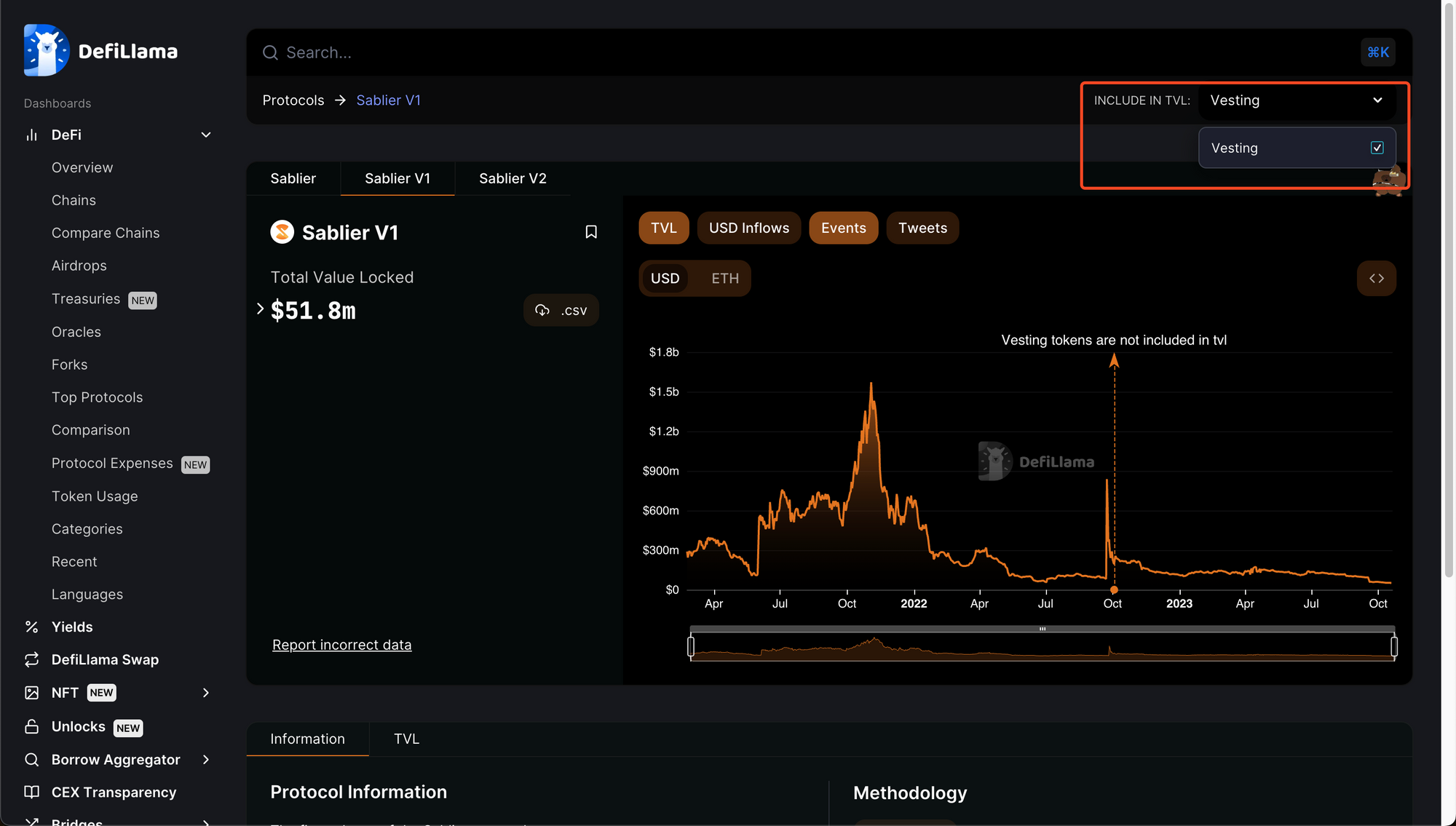

In 2022, DeFiLlama made the decision to exclude vesting tokens from their default TVL metrics. This article will explain why this approach is bad and propose an alternative methodology that is fairer and more accurate.

The Problem with Simple Price Multiplications

DeFiLlama realized that the simple method for calculating TVL—simply multiplying the number of tokens by their current price—had glaring issues for vesting tokens (VTs) with small market caps. This method resulted in TVLs that were disproportionately high compared to the actual market cap, creating a distorted picture, e.g., $100M TVL for a token with only $10M in market cap.

While DeFiLlama still retains this methodology as an option in their UI, it is tucked away under an "Include in TVL" dropdown menu.

Case in Point: The Sablier V1 Dashboard

As of writing this article, DeFiLlama reports a TVL of $3.44M for Sablier V1. But when VTs are included, the figure increases to $51.8M. Let's take a closer look at what makes up this TVL.

- Standard TVL ($3.44M): stablecoins and native tokens like ETH and MATIC.

- Vesting TVL ($48.46M): various assets such as $COMP, $FOX, and $ICHI.

Rethinking TVL: TOV Included

Now, consider this thought experiment:

What would happen if Sablier V1 were to be hacked? The hacker would likely liquidate the VTs in exchange for more liquid, non-VTs like ETH or stablecoins. So, is it reasonable to assign a zero value to VTs sitting in Sablier? Clearly, the answer is no. But if we agree that $48.46M is an inflated figure, what's the real value?

The solution is to anchor the value of vesting tokens to the equivalent value of non-vesting tokens obtainable through a counterfactual hack of the smart contract. And the easiest way to estimate this value is by querying data from DEX aggregators like 1inch.

We used 1inch and estimated the USDC value that would be obtained by liquidating specific tokens currently locked up in Sablier V1:

| Vesting Token | Obtainable Value | Simple Price Value |

|---|---|---|

| $COMP | $879K | $1.54M |

| $FOX | $840K | $2.07M |

| $ICHI | $145K | $485K |

The obtainable value is smaller than the simple price value but it is still significant.

Of course, this is an incomplete model. For one thing, using 1inch means ignoring liquidity on centralized exchanges and other chains. For another thing, actual hackers would employ more sophisticated liquidation strategies, such as selling small amounts over multiple days and submitting orders on different exchanges.

However, even with these caveats, this is a substantial improvement over the current approaches that disregard the value of VTs entirely.

Conclusion: Use TOV in Your TVL Aggregator

VTs locked up in smart contracts are funds at risk. If there is a bug, hackers can swap the VTs for non-VTs. We refer to the value of these non-VTs as Total Obtainable Value (TOV), and we argue that all TVL aggregators should include this TOV in the TVL calculated for smart contracts that hold VTs.